Rice: World Markets and Trade

For 2016/17, global production is raised even further to a new record.

OVERVIEW

For 2017/18, global production is revised lower this month on smaller crops in Bangladesh, Sri Lanka, and the United States. Consumption is down fractionally, while stocks continue to grow with additional carryin supplies in Thailand. Global trade is revised higher this month to just below the 2014 record. The U.S. season-average farm price is raised.

For 2016/17, global production is raised even further to a new record. Trade is revised up on increased demand from Bangladesh, the Philippines, and Sri Lanka.

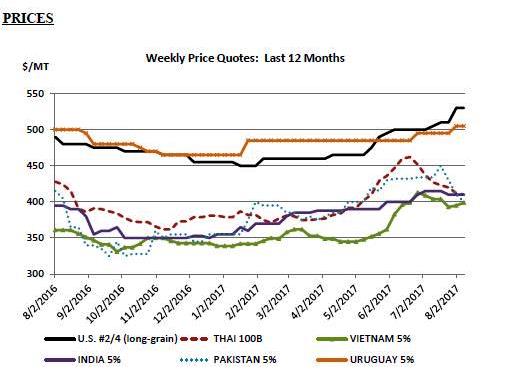

PRICES

Over the past month, Asian quotes have generally declined, while those in the Western Hemisphere have risen. Thai and Indian quotes have converged around $410/ton, pressured lower by new crop supplies. Likewise, Pakistani and Vietnamese quotes have both settled just under $400/ton in the midst of their respective harvests.

Sri Lanka’s Market Share of Global Rice Imports

FEATURE

Sri Lanka’s reduction in domestic rice supplies is spurring its return to the global market. Sri Lanka’s recent rice crops have been affected both by untimely flooding and its worst drought in 37 years. Subsequent seed shortages and diminished reservoir levels are hampering recovery efforts. See August 2017 World Agricultural Production for further details.

Although Sri Lanka started the year with ample carryin stocks still available from the record 2015/16 crop, the government has depleted most of these stocks by releasing them to stabilize prices. Despite the government’s urging traders to sell their rice stocks, the sale of private stocks has been limited as traders continue to wait for higher prices. With these constraints on domestic supplies, prices have continued to rise.

As a result, Sri Lanka is set to import a record 700,000 tons in 2017. Several countries, including Indonesia, India, and Pakistan have supplied limited amounts of food aid. However, the bulk of the imports are being negotiated through agreements with neighboring countries including India, Thailand, Vietnam, and Burma. In addition, the Sri Lankan government has substantially lowered the import tariff to encourage additional imports.

Over the past 60 years, Sri Lanka has become far less dependent on imports due to a steady increase in production. In the 1960s, Sri Lanka accounted for almost 10 percent of global rice imports while it has been virtually absent from the global rice market since 2000. The anticipated imports in 2017 would cause its share in global trade to surge once again.

Selected Trade Changes for 2018

• Sri Lanka imports are boosted 350,000 tons to 400,000 due to increased government efforts to offset the severe impact of drought on domestic production.

• China exports are raised 100,000 tons to 1.0 million on expectations of continued large shipments to Africa.

• Egypt exports are cut in half to 100,000 tons as the government continues to restrict exports.

• India exports are lifted 500,000 tons to 11.5 million due to continued regional demand.

Selected Trade Changes for 2017

• Bangladesh imports are up 100,000 tons to 800,000 on government purchases to restore supplies after a poor crop.

• Nigeria imports are revised up 100,000 tons to 2.2 million on trade to date.

• Philippines imports are raised 200,000 tons to 1.6 million based on larger government purchases to replenish tight stocks.

• Sri Lanka imports are boosted 300,000 tons to 700,000 due to increased government efforts to offset the severe impact of drought on domestic production.

• China exports are raised 100,000 tons to 900,000 on continuously larger shipments to Africa.

• India exports are boosted 500,000 tons to 11.0 million due to higher drought-driven demand from Bangladesh and Sri Lanka.

• Vietnam exports are revised up 200,000 tons to 6.0 million on stronger sales within the region and a new government-to-government deal with Bangladesh.